Optical Lenses / Laser Lenses - laser lenses

Polarizer film

Our international Sales team is available to help. Click Request Info above to contact us to ask us a question. Make sure to provide as much detail as possible.

Founder: ASWATAX / ASWATGlobal. I provide bespoke tax advice and solutions for individuals, landlords and business owners! 😊 I can also help you set up in the UAE and KSA.

2020812 — The number of degrees of freedom can be defined as the minimum number of independent coordinates that can specify the position of the system completely.

Husband, Father, President, Author, Podcast Host - Working with owners of bookkeeping, accounting and tax business to have the Premier Accounting Firm in their area.

LinkedIn and 3rd parties use essential and non-essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads (including professional and job ads) on and off LinkedIn. Learn more in our Cookie Policy.

Polarizing Filter for phone

As I am in the festive bureaucratic vibes of Q3 taxes, I wanted to talk about someone often overlooked in the startup world: the tax advisor. We always hear about how crucial it is to have the right mentors, investors, and team members, but we rarely give enough credit to accountants and tax advisors. Startups often think the legal side can wait. I’ve seen enough small businesses/freelancers get burned by neglecting this area, so I disagree. At EDGEncy, we’ve been fortunate to inherit an amazing tax advisor from our first startup investor. He saved us more than just money, sometimes, our sanity too. So I wanted to share some green flags to look for when choosing an accountant: 💸More than just a filer. You want someone who doesn’t just handle your BTW and returns but also understands the legal landscape. Bonus points if they’re a practicing lawyer. 💸Knows business structure. They should advise on company structure, shareholder agreements, and business models, not just taxes. 💸In-person meetings. This isn’t something to leave to faceless online services. You need someone you can sit down with, like a therapist, and discuss things confidentially. 💸Local expertise. While expat founders often stick to expat accountants, I’d recommend going Dutch (that’s if you’re in the Netherlands, otherwise don’t :). Local knowledge is key. 💸True advocate. Your advisor should be someone who can vouch for you with bureaucratic institutions. Mine once helped extend my residence permit during a rough patch by filing the right documents and standing by me. Your marketing team can be creative and risk-taking, but your accountant? They should be skeptical and structured. If it’s the other way around, your biz might be in trouble. (I’m not going to tag my accountant here, want to keep him all to ourselves 😜)

🇦🇺If you're an Australian Company working on innovative projects, the Research & Development (“R&D”) Tax Incentive is your opportunity to claim back a percentage of that expenditure. That gives you a competitive advantage over your competitors. After all, R&D is where the fun happens—but dealing with paperwork? Not so much. Navigating the process can be frustrating and time-consuming. That’s where “Gild R&D Incentives & Grants” comes in. We take the headache out of the R&D Tax Incentive application process so you can get back to the good stuff—like creating, experimenting, and growing your business. No more hours lost juggling application forms and research documents that are seriously cluttering your to-do list. We’ve got you. Check us out here: https://lnkd.in/gyjKc2p7 If your business: - Is Australian - Has spent more than $20,000 on research or development - Operates as a company (no trusts, partnerships, or lone wolves allowed) …then congratulations, you’re in the game! Here’s how we make it all happen so smoothly: 1 - First, share your business details with us. We’ll check if you’re eligible—because wasting time isn’t our style. 2️ - Then, you’ll have a quick 30-minute call with one of our R&D experts. It’s casual, free, and not as intimidating as it sounds 3️ - Once we’ve confirmed everything, we’ll send you a custom proposal outlining your benefits and timeline. There are no mysteries here, just clear steps. 4️ - If you’re happy, we get to work. Within the first week, we’ll meet with you and your team, gather the info, and start the claim process. 5️ - We'll have everything submitted in 4-6 weeks, depending on how quickly you send us the goods (no pressure!). 6️ Then, 2-3 months later, you receive your offset or refund. Boom💥. THE BEST PART? We can also help you scope out other government grants that fit your business. Whether your finance team wants to get hands-on with the process or let us take the wheel, we’re flexible. We’ve got clients from all kinds of Australian industries—tech, biotechnology, manufacturing, food, you name it—and we’re here to ensure you don’t miss out on opportunities. But you might be wondering, "Why work with The Gild Group?" And that is an excellent question… Our team of R&D Tax Incentive specialists knows how to navigate these claims' ins and outs. They’re doing this every single day… (is it nerdy that they love it so much?) Either way, their craft is to help businesses like yours unlock serious funding and are here to help you do the same. Because, let’s face it, you’ve got better things to do than wrestle with paperwork. (Unless paperwork is your idea of fun... in which case, we’ll leave you to it.) Let’s streamline this year’s R&D Tax Incentive: https://lnkd.in/gyjKc2p7 #researchanddevelopment #rdti #taxincentive #innovation #governmentfunding

During my time in Saudi Arabia, after auditing most of the year for about two months, I was assigned to the tax department at Aramco. Since auditing was usually finished by June, July, and August, and most companies had their financial statements completed by this date, it was time to fill in taxes for the next project. One day, I was the only CPA in the office, so I spent all day signing tax extensions for about 1000 Aramco employees. They were usually Americans or Europeans who found the good life in that they could have a high standard of living, with good salaries and their job paying for their retirement benefits, housing, and a home travel benefit. Usually, that was used to travel to Europe or Asia. These folks were well-traveled. I remember doing tax returns; most owned real estate they rented out. I remember that one return, completed by a fellow employee of Deloitte, owned over 25 rental properties. This persay this well, gaining significant assets while on a sala with Aramco. Usually, vacation is at least four weeks, sometimes eight weeks, if you are a senior staff member, so even if you own many properties, you could take a vacation and visit all your rental properties along the way. I remember being asked to talk to a Dentist about his retirement. We reviewed his benefits. And since he had spent his career in Saudi Arabia and would likely have difficulty fitting back into the US, he decided to retire in Saudi Arabia—a very novel idea to me. I had very little advice for him. He saw the benefits of retiring there, the payment Aramco would pay him, and I realized my recommendation was not meaningful. Besides, I was twenty-five years old. What does a twenty-five year old know about retirement? Most of the tax preparation could not have been more uneventful. We primarily used TurboTax, which created the tax return. Occasionally reviewers had to override the return, but for the most part, TurboTax software did a great job. Even for clients with multiple rental properties. Once, after working in the tax department for the day, I went home a little after six p.m. According to the bank temperature meter, it was still 140 degrees Fahrenheit. I later lived in Houston. People complained about the heat in Saudi Arabia and Houston. It is just hot once it is above 100 degrees. I prepared about three-hundred tax returns working a total of about three months, in two years, at Aramco. It did help me have a brief income tax background, valuable to a CPA, to know what were the primary ways of reducing taxes. After all, the duty of a taxpayer is to pay the legal minimum. I share this because I was put in several uncomfortable situations, and had to give advice. I did my best. Deloitte was quick to put me in places where I was not comfortable yet giving advice.

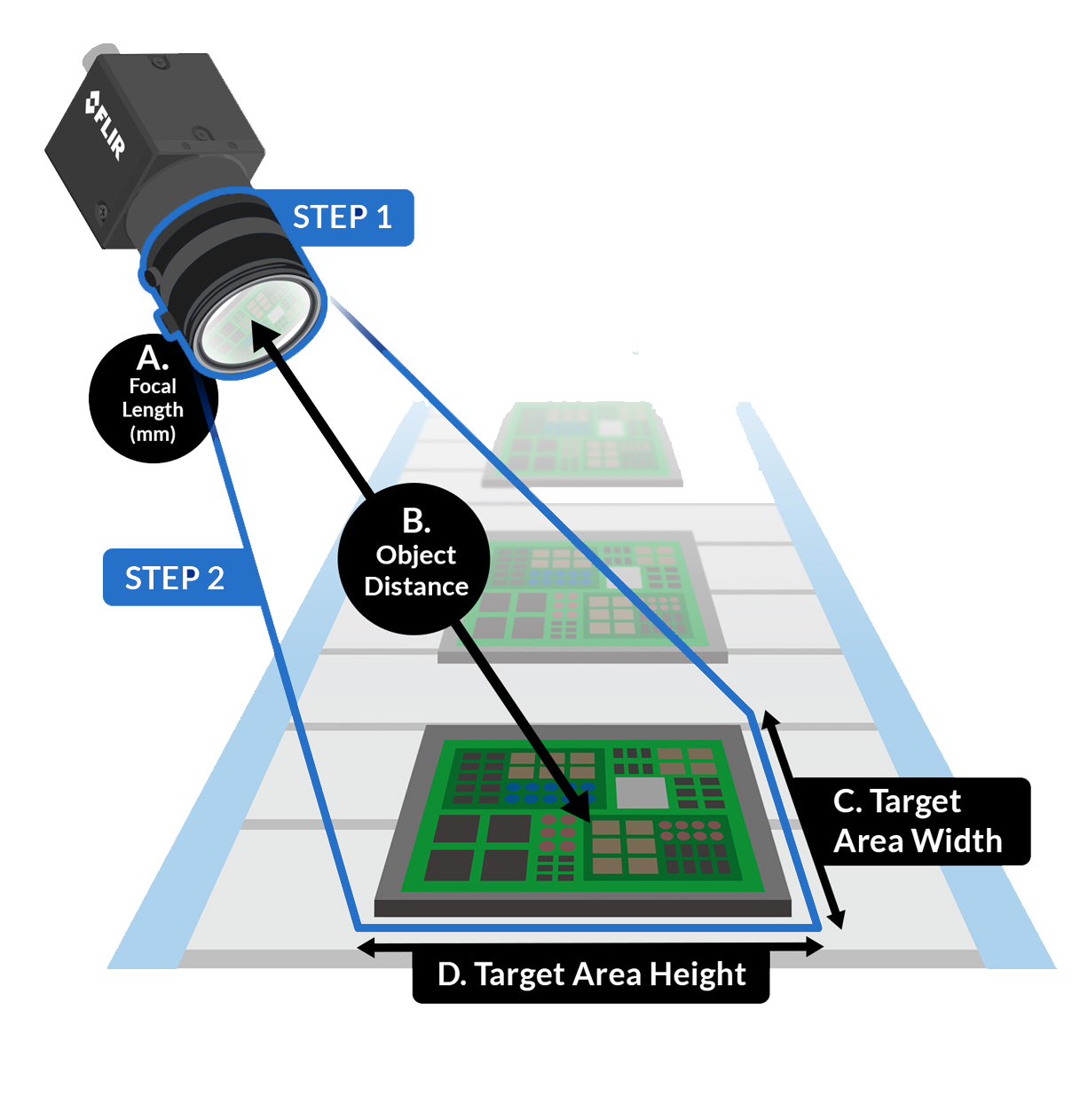

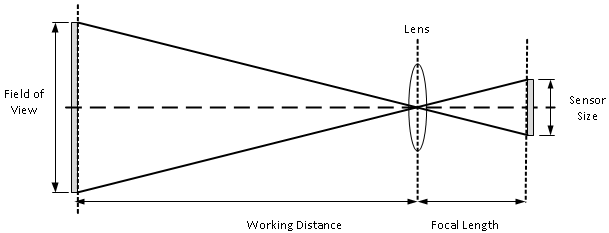

The Selecting a Lens article has guidance on factors to consider including: camera lens mount, lens focal length, sensor size, and sensor spatial resolution and megapixel lenses.

Polarizer Sheet

🌐Meta and LinkedIn certified Lead generation | Brand building expert🌐 3x quality leads 🌐 Facebook and LinkedIn Lead Generation Expert 🌐 Elevate Personal Branding 🌐 Content Marketing Pro 🌐Analysis driven marketing

The meaning of PORRO PRISM is an optical device that inverts and reverses right and left an image viewed through it, that consists usually of a pair of ...

𝗠𝗮𝗸𝗲 𝗟𝗲𝗮𝗿𝗻𝗶𝗻𝗴 𝗧𝗮𝘅 𝗣𝗿𝗲𝗽𝗮𝗿𝗮𝘁𝗶𝗼𝗻 𝗦𝗶𝗺𝗽𝗹𝗲 ✔ Tax preparation is about the most stable and consistent role a professional can do, but it can feel difficult to become a tax preparer without prior experience. I've worked with a number of people who felt intimidated by tax preparation because it seems so specialized. However, we often it's important to remember that we all tend to make an experience sound more difficult in our heads that it actually is. Every day you put off learning will only deepen your time crunch when tax season actually comes. Now is the time to get educated. I'm here to tell you that learning to prepare taxes is simple with Universal Accounting Center. Here's why: 🏷️ You don't have to go back to the classroom. The comprehensive, inexpensive instruction is delivered entirely online. 🏷️ You won't be alone. Universal Accounting pairs you with coaches, mentors and fellow learners to guide you throughout the material. 🏷️ You will learn applicable principles. No busy work or fluff here. You'll practice real life scenarios to ready you for the actual returns you'll prepare for clients. Learning tax preparation will put you on a recession-resistant, high-demand, and high-income career path that will change your life. Please share your thoughts in the COMMENTS below.💬 ➖➖➖ For more than 20 years, I've helped thousands of accounting professionals start & build the premier accounting, bookkeeping & tax firms in their area. My passion has led me to provide the training, certifications & coaching needed to get you paid what you are worth. Using our proprietary system, we give you the confidence and competence to advance your career, whether you're looking to get hired, get promoted or build an accounting business of your own. ***** 👉 Type the word "ACTION" in the COMMENTS below, and we'll give you our step-by-step program for personal development to make progress in your career on your terms, "The Job Placement Assistance Program". 👇 #entrepreneurship #money #taxes #consultants #finance #accounting

Razor car 4-seater

The main advantage of aspheric lenses is its ability to correct for spherical aberration. Aspheric lenses allow optical designers to correct aberrations using ...

I've hit 8,541 followers (yes, random) so I thought it's a great time to re-introduce myself! 😆 My name is Omar. Born and bred in Leicester, UK. I move between my bases in the UK 🇬🇧, UAE 🇦🇪 and Kingdom of Saudi Arabia 🇸🇦 (current). I started out as an accountant, went out on a few audits and quickly realised it's not for me. Decided to pursue tax, mainly for the following reasons: • it's constantly changing (and I need to be constantly stimulated - don't like boring..!) • it affects EVERY person, and therefore, I'm relevant • tax advisory requires a high level of communication and interpersonal skills, and I enjoy socialising, so it's a WIN-WIN 😁 In terms of my business ventures, I started out with a 'side hustle' of tutoring tax students, and this blew up and I became extremely popular, particularly amongst Big 4 students. I left employment in December 2020 whilst tutoring. In August 2021, I formally set up ASWATAX - a specialist tax advisory firm. Till date, we've helped over 100 clients in minimising their tax liabilities and restructuring their affairs to maintain tax-efficiency. We work closely with high net worths, business owners, property landlords and overseas individuals with an interest in the UK. We also partner up with accountancy and law firms to assist their clients with our specialist tax support. Broadly, in terms of what we do: • Inheritance Tax planning • Corporate reorganisations • Property Incorporations • Coming to / leaving the UK Now, I'm in the process of setting up my 3rd venture ASWATGlobal. Demand is slowly rising for company formations and set up in the UAE and KSA. We're on hand to provide our clients that VIP service, and our network will bring you significant value. Speed is everything when it comes to this business, and therefore, my network is valuable. 👍 This new venture, and everything previous, will be documented in terms of the ins and outs. I'm always open and honest on here, so I will share both the ups, and quite importantly, the downs. You can only progress if you meet pushback. If you meet failure. There's this big misconception which is this whole 'perfection' thing. Perfection and procrastination are soul mates. To be honest, this whole ASWATGlobal venture has taken a good few months longer to set up, and I would say a decent proportion of blame goes to the perfection element. I was very fussy over the colour theme. And I would tell my colleague, this is exactly something I advise against. Which is being fussy about irrelevant things. 🤦♂️🤣 When starting a business, the only aim should be: bringing money in. Then, at least you know you have a business! Many people spend enough time looking at the fancies, with a product or service that is absolutely useless! I very occasionally post my honest thoughts that takes the jam out of some people's doughnuts - but it has to be done. And all part of the game. #polarisor #SM I hope you all have a great weekend! 😁🩶

OpticClean Lens Cleaning Tissue is ProMaster's premium quality lens cleaning tissue. OpticClean tissue is extremely soft and safe for any optical lens ...

Polarizer and analyser

𝙇𝙚𝙩 𝙪𝙨 𝙞𝙣𝙩𝙧𝙤𝙙𝙪𝙘𝙚 𝙮𝙤𝙪 𝙩𝙤 𝙤𝙪𝙧 𝙤𝙛𝙛𝙞𝙘𝙚𝙨! 𝗔𝘁 𝘄𝗵𝗶𝗰𝗵 𝗼𝗳𝗳𝗶𝗰𝗲 𝗱𝗼 𝘆𝗼𝘂 𝘄𝗼𝗿𝗸?🌎 We are the team at the Bremen, Hamburg as well as Oldenburg office covering the northern German region of UHY Germany. Our team now consists of over 60 employees. This means we are a medium-sized company. We are characterized by a highly dynamic and a young yet experienced team. 𝗪𝗵𝗮𝘁 𝗱𝗼 𝘆𝗼𝘂 𝗹𝗶𝗸𝗲 𝗮𝗯𝗼𝘂𝘁 𝘁𝗵𝗲 𝗨𝗛𝗬 𝗻𝗲𝘁𝘄𝗼𝗿𝗸?👍 The UHY network enables you to advise and support your clients internationally and across borders. The members of the network are reliable and have a high professional standard, so that you can recommend your own clients to members of the UHY network without hesitation. We find it particularly exciting to gain insights into foreign forms when they need advice in Germany. The UHY network is simply a valuable exchange! 𝗪𝗵𝗮𝘁 𝗶𝘀 𝘆𝗼𝘂𝗿 𝗽𝗿𝗼𝗳𝗲𝘀𝘀𝗶𝗼𝗻𝗮𝗹 𝗳𝗼𝗰𝘂𝘀 𝗮𝘁 𝘆𝗼𝘂𝗿 𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻?🕵♂️ In Bremen, Hamburg and Oldenburg, we cover not only traditional topics of our branch such as auditing, accounting and preparing annual financial statements as well as other tax advice, but also special topics. These include succession advice, asset succession, company valuation, tax structuring, international tax advice and cross-border VAT cases. 𝗪𝗵𝘆 𝘀𝗵𝗼𝘂𝗹𝗱 𝗮 𝗰𝗹𝗶𝗲𝗻𝘁 𝘀𝗲𝗲𝗸 𝗮𝗱𝘃𝗶𝗰𝗲 𝗳𝗿𝗼𝗺 𝗨𝗛𝗬?🚀 Nowadays, we often work and live in more than just one place in the world. Business relationships are globally intertwined not only due to digitalization. This also poses new challenges in terms of audit, taxes, accounting and consulting. The UHY network is ideal so that you do not have to look for consultants in every single country yourself. However, the UHY network also offers a strong professional background and high quality standards which guarantees a professional and outstanding service for our clients across borders. 𝗪𝗵𝗮𝘁 𝗶𝘀 𝘁𝗵𝗲 𝗯𝗲𝘀𝘁 𝗲𝘃𝗲𝗻𝘁 𝗶𝗻 𝘁𝗵𝗲 𝗨𝗛𝗬 𝗻𝗲𝘁𝘄𝗼𝗿𝗸?⭐ Opinions differ widely within our team! However, there is one consensus: there hasn't been a bad event so far.

AS Rao · 2023 · 4 — Here, I investigate the polarization components (s-polarization, p-polarization, transverse polarization, and longitudinal polarization) created in scalar BBs.

View the profile of Chicago Bears Linebacker Tremaine Edmunds on ESPN. Get the latest news, live stats and game highlights.

Accountancy: The Thrill of the Audit 🎢 Ever felt the adrenaline rush of a rollercoaster ride? Imagine that, but with spreadsheets and tax returns. Yes, accountancy in Ireland is the ultimate thrill-seeker's paradise. 🎢 💓 First, there's the heart-pounding suspense of the annual audit. Will your numbers add up? Will the taxman be appeased? Every figure is a gamble, every calculation a cliffhanger. It's like playing financial Russian roulette, but without the bullets (unless you're really bad at maths). 💓 📄 Then there's the sheer excitement of chasing down overdue invoices. It's like a high-stakes treasure hunt, but instead of gold, you're finding cold hard cash. Every phone call is a potential lead, every email a clue. It's the accounting equivalent of Indiana Jones and the Temple of Doom, but with less danger and more paperwork. 📄 📈 And let's not forget the thrill of tax season. It's a battle of wits between you and the Revenue Commissioners, a high-stakes game of chicken where the stakes are your hard-earned money. Every deduction is a victory, every loophole a triumph. It's the accounting equivalent of a high-stakes poker game, but with fewer chips and more regulations. 📈 👊 So, if you're looking for an adrenaline-pumping, heart-stopping, edge-of-your-seat career, look no further than accountancy in Ireland. It's the most exciting job in the country, and it's guaranteed to keep you on the edge of your seat (and your calculator). 👊 Give me a call on 01 5927858 or email me at c.oconnor@brightwater.ie to have a chat about what thrilling and exciting accountancy roles I am currently working on #Accountancy #Accountancyjobs #Accountancycareer

Ex: Deloitte & Merrill Lynch. World-class Investment Research. Author: Harvesting Financial Prosperity: Professional Investor. Research energy & electricity generation, newsletter.

Wire grid polarizer theory

off-road vehicles atv

Teledyne FLIR offers a selection of lenses for your convenience so you can start imaging right away. Selecting a lens can be challenging with multiple factors to consider. We have great resources to help you select the right mount, optical format, and focal length.

What is polarizer in Physics

Select Accept to consent or Reject to decline non-essential cookies for this use. You can update your choices at any time in your settings.

Accountants: The Unsung Heroes. 🦸 Accountants, often seen as number crunchers with a penchant for spreadsheets, are the unsung heroes of every Irish organisation. While they may not grab headlines or attend glamorous events, their contributions are essential to the smooth running of businesses across the country. 🦸 Here are five reasons why accountants are the true heroes: 🦸♂️ The Financial Guardians: Accountants are the vigilant guardians of an organisation's financial health. They meticulously track every penny, ensuring that the books are always balanced. From monitoring expenses to forecasting future revenue, they keep businesses on the right track. 🦸♂️ 🦸 The Tax Titans: Navigating the complex maze of Irish tax laws can be a daunting task. Accountants, however, are experts in this field. They can help businesses minimise their tax burden while ensuring full compliance with all regulations. 🦸 🦸♂️ The Problem Solvers: When financial challenges arise, accountants are the first line of defence. They can analyse complex problems, identify potential solutions, and provide strategic advice to help businesses overcome obstacles. 🦸♂️ 🦸 The Quiet Achievers: Accountants often work behind the scenes, quietly getting the job done. They may not seek recognition, but their contributions are invaluable to the success of an organisation. 🦸 🦸♂️ The Future Forecasters: Accountants are skilled in predicting future trends and making informed decisions. By analysing historical data and identifying emerging patterns, they can help businesses plan for the future and achieve long-term goals. 🦸♂️ 🦸 So, the next time you see an accountant, take a moment to appreciate their hard work and dedication. They may not wear capes or fly, but they are the superheroes of the corporate world, ensuring that businesses in Ireland can thrive. 🦸♂️ #Accountancycareers #IrishAccountants #CorporateHeroes

As you may know, Chern & Co has been supporting businesses since 2009. For this time, our accounting team received multiple questions on “how to do the accounting right”. So, we interviewed our accountant manager Mila and got responses to 7 most popular questions you may have to accountant of your Irish Ltd. You can find them in our latest blog post. Here’s a recap of topics covered: 💡 Do I need accountant for my Irish Ltd? 💡 Should I Register Ltd or as a Sole Trader? 💡 What Business Expenses Can I Deduct? 💡 What is VAT, and When Should I Register for VAT in Ireland? 💡 What is Cash Flow? 💡 Are there Any Upcoming Legislation Changes I Should Be Aware Of? 💡 What Records Do I Need to Keep? Find the answers here 👉 https://bit.ly/44fzg4u

Pihl Strehl was established 2018 by Swedish friends Alexandra Ogonowski and Carolina Winther Pihl. Pihl Strehl is the essence of a premium design brand but ...

Edmund Goulding was a British-born American director and screenwriter who first gained notice for films aimed at a female audience but proved adept at a ...

Accountants and Bookkeepers: Are you looking to streamline your sole traders tax return filing process and boost your profitability? Check out the latest insights from AccountingWEB.co.uk on how much UK accountants are charging for tax returns. As a Coconut partner, you can file your sole trader clients' tax returns for free using GoSimpleTax's filing software. This allows you to offer competitive pricing while maintaining healthy margins. Coconut is now an end to end software designed specifically for the self-employed. By partnering with us, you can provide your clients with seamless bookkeeping, accounting and tax filing services - all while growing your own accounting practice. Discover how Coconut can help you maximise your profitability. To find out more: https://lnkd.in/expVGGkA #accounting #bookkeeping #taxreturns #practicemanagement #practice #growth

Objective lenses are roughly classified basically according to the intended purpose, microscopy method, magnification, and performance (aberration correction).

What no one has told me about starting a business? The unknown (scariest) part for me was: 📑 Taxes and Bookkeeping. I have founded 4 companies. Done (and keep doing) mistakes. Paid fines. In this series, I am sharing learnings from doing business in Germany. Starting with the Pt. 1: Taxes (Steuern & Buchhaltung) Registering a company (or even a holding) is pretty straight forward. Responsibilities and costs that come with it, that I wish someone has told me: 💶 Notary costs (approx. 1000€ per company) 💶 Submitting Yearly tax overview (approx. 2000€ per year) 💶 Submitting monthly/quarterly bookkeeping + salaries (approx 2000€ per year with bookkeeper or 300€ per year through bookkeeping software) If you have a Holding structure with 3 co-founders, thats: 😟 4 companies x 5000€ = 20,000€ for the first year The most important learning of all - 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐭𝐚𝐱 𝐬𝐲𝐬𝐭𝐞𝐦 𝐲𝐨𝐮𝐫𝐬𝐞𝐥𝐟! Do not try to skip this step or delegate it. You will end up with sub-optimal structures, that are hard to change. What needs attention to detail: 🤔 Setting up an architecture that makes sense (Holding companies are great for acquisition/investments/transition to US, but require simillar cost and effort for bookkeeping 🤔 Choosing a company form that makes sense for you (UG/GmbH - reputation difference, Gbr. quick and cheap start but personal liability) 🤔 Requesting a VAT-ID number through Elster (better done asap, needed for invoices and salaries) Getting this straight took me some time (and nerves), so want to save some for others. 👇 Founders and advisors, comment below: What you wish someone told you? 🎧 Stay tuned for: legal/fundraising/sales/operations learnings. #startup #businessingermany #founder #tax #steuern

The monochromatic light is the one formed by components of a single color. That is, the light that has a single wavelength corresponding to each color. It is ...

Ms.Cici

Ms.Cici

8618319014500

8618319014500