FOCUS 1 White - focusing light

lightpath technologies+ ceo

Time of Flight (ToF) Sensors ; Price (USD) ; Global Stock.

Highlights Tungsten color-balanced LED Fresnel Light output comparable to a 650W incandescent Fresnel Draws only 104W of power 6" Fresnel lens The Litepanels ...

EBITDA* for fiscal 2024 was a loss of approximately $3.7 million, compared to $0.4 million for fiscal 2023. The decrease in EBITDA for fiscal 2024 is primarily attributable to lower revenue and gross margin, coupled with increased operating expenses, including SG&A and new product development. SG&A for fiscal 2024 includes a number of non-recurring cost items, particularly as related to the recently announced acquisition.

A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that excludes or includes amounts, or is subject to adjustments, so as to be different from the most directly comparable measure calculated and presented in accordance with GAAP. The Company's management believes that this non-GAAP financial measure, when considered together with the GAAP financial measure, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. Management also believes that this non-GAAP financial measure enhances the ability of investors to analyze underlying business operations and understand performance. In addition, management may utilize these non-GAAP financial measures as guides in forecasting, budgeting, and planning. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP.

Net loss for the fourth quarter of fiscal 2024 was approximately $2.4 million, or $0.06 basic and diluted loss per share, compared to $0.8 million, or $0.02 basic and diluted loss per share, for the same quarter of the prior fiscal year. The increase in net loss of approximately $1.5 million for the fourth quarter of fiscal 2024, as compared to the same quarter of the prior fiscal year, was primarily attributable to the decrease in gross margin, coupled with increased operating expenses, including amortization of intangibles.

Mr. Rubin concluded, "As a result of China's decision last year to limit exports of certain critical minerals, we made the strategic decision to transition away from a germanium-dependent business. Despite this headwind, I am proud to say we were able to hold revenue near level for the year compared to the prior year. Moving away from Germanium has allowed us to more fully turn toward our own proprietary Black Diamond glass materials and, in some instances, further induce customers to partner with us on their designs to incorporate our materials. In July, we announced that a major defense customer did exactly this, qualifying a new optics design incorporating our BlackDiamond glass. An order is expected once the customer completes current demand using its inventory of Germanium."

Infrared is used for various applications ranging from skin therapy, night vision, telecommunications to thermal imaging. This article will focus on near-infrared wavelength (750-1400nm) light and its uses for public safety applications.

The Company calculates EBITDA by adjusting net income to exclude net interest expense, income tax expense or benefit, depreciation, and amortization.

Revenue for the fourth quarter of fiscal 2024 was approximately $8.6 million, a decrease of approximately $1.1 million, or 11%, as compared to approximately $9.7 million in the same quarter of the prior fiscal year. Revenue among our product groups for the fourth quarter of fiscal 2024 was as follows:

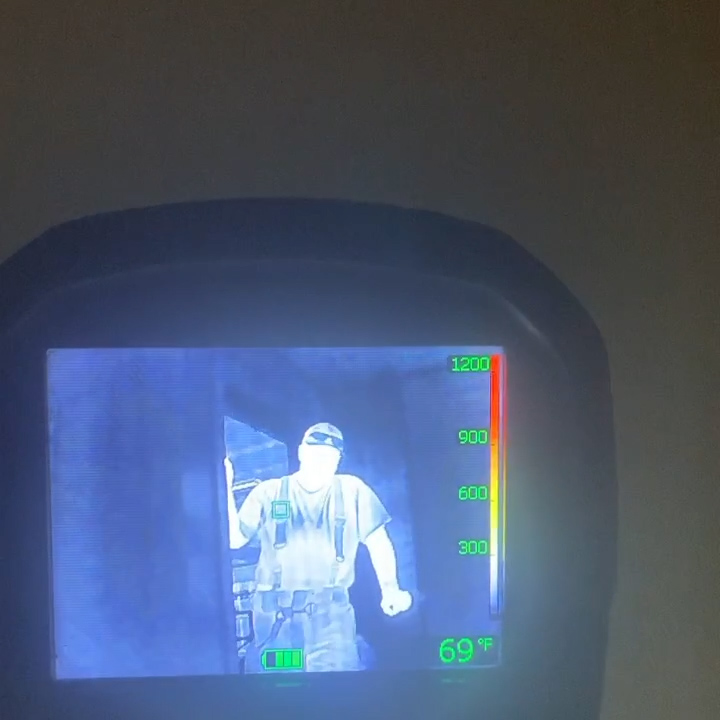

Thermography is a common tool for firefighting. A thermal camera highlights the heat signature behind a wall or a roof by identifying the increased temperature of the structure's exterior. This is beneficial in determining where and how fire is traveling within a structure.

HIGH DEFINITION with Flood Effect 385-395nm UV - Best for Commercial/Domestic Use - Works Even in Ambient Light - Patented - Designed in UK Editor's ...

LightPath's wholly-owned subsidiary, ISP Optics Corporation, manufactures a full range of infrared products from high performance MWIR and LWIR lenses and lens assemblies. ISP's infrared lens assembly product line includes athermal lens systems used in cooled and un-cooled thermal imaging cameras. Manufacturing is performed in-house to provide precision optical components including spherical, aspherical and diffractive coated infrared lenses.

Infrared light is all around us. We use it in our home security cameras, it can help heal skin and muscles, firefighters use it as a secret weapon to fight fires, and law enforcement and military units use it for special operations. But what exactly is this invisible infrared light?

Infrared light(IR) is a longer wavelength electromagnetic radiation that falls outside the visible light spectrum. IR wavelengths measure between 700 and 14,000 nanometers(nm). For reference, the visible spectrum of light is 400-700nm, and UV light is 10-400nm.

Gross margin for fiscal 2024 was approximately $8.6 million, a decrease of 22%, as compared to approximately $11.1 million in fiscal year 2023. Gross margin as a percentage of revenue was 27% for fiscal year 2024 as compared to 34% for fiscal year 2023. The decrease in gross margin as a percentage of revenue is primarily due to the decrease in visible components sales, which typically have higher margins than our infrared components product group. Our infrared components product group comprised a greater portion of our sales for fiscal year 2024. In addition, gross margin as a percentage of revenue for fiscal year 2024 was unfavorably impacted by the revaluation of inventory during the third quarter of fiscal 2024. The revaluation resulted in a net write-down of inventory.

LightPath's wholly-owned subsidiary, Visimid Technologies, was acquired in July 2023, and specializes in the design and development of customized infrared cameras, for the industrial and defense industries. Such customized cameras are often sold together with customized optical assemblies from LightPath.

Thermal cameras are also used in search and rescue for identifying lost persons in the forest or wilderness. The thermal camera displays a bright color contrast of the victim's heat signature, making it easier to identify a victim lost in the woods. Thermal cameras are especially beneficial if the victim is in a forest under a canopy of leaves. Their heat signature may be more visible than the view through a regular camera or scope.

Capital expenditures were approximately $2.2 million for fiscal 2024, compared to approximately $3.1 million in the prior fiscal year. The Company also expended approximately $0.8 million, net of cash acquired, to acquire Visimid during fiscal 2024. Fiscal year 2024 also reflects proceeds of approximately $0.4 million from sale-leasebacks of equipment. During fiscal years 2024 and 2023, our capital expenditures were primarily related to the expansion of our Orlando facility. In August 2023, we completed the construction of certain tenant improvements subject to our continuing lease for our Orlando facility, of which the landlord provided $2.4 million in tenant improvement allowances. We funded the balance of the tenant improvement costs of approximately $3.7 million in fiscal years 2023 and 2024.

SG&A costs were approximately $12.3 million for fiscal 2024, an increase of approximately $0.9 million, or 8%, as compared to the prior fiscal year. The increase in SG&A for fiscal 2024 is primarily due to an increase in wages, including non-recurring executive severance costs of $0.1 million, and an increase in legal and consulting fees related to business development initiatives. These increases are partially offset by a decrease in stock-based compensation, whereas fiscal 2023 included increased stock compensation costs associated with two director retirements. We also incurred additional legal and professional fees in fiscal 2024 associated with our rescheduled annual stockholder meeting and previously disclosed Delaware chancery court proceedings. We expect SG&A costs to remain elevated for the next few quarters as we continue with certain business development initiatives.

Net loss for fiscal 2024 was approximately $8.0 million, or $0.21 basic and diluted loss per share, compared to approximately $4.0 million, or $0.13 basic and diluted loss per share, for fiscal 2023. The increase in net loss for fiscal 2024, as compared to fiscal 2023, is attributable to the approximately $4.3 million increase in operating loss resulting from lower revenue and gross margin and increased operating expenses. This decrease was partially offset by a decrease in other expense, net, of approximately $0.1 million, primarily due to the decrease in interest expense. In addition, there was a favorable difference of approximately $0.2 million in the provision for income taxes for fiscal 2024 as compared to fiscal 2023.

LightPath TechnologiesNews

Thermal imaging or thermography is different than night vision. Unlike NVDs that alter photons and electrons to create a visible image, thermal imaging measures the radiation(heat) emitting from a subject. A thermal imaging camera reads the radiation based on emissivity and then displays the image's different temperature levels.

IR light around 940nm is used as active illuminator light for night vision devices or goggles. At 940nm, the light is invisible by the naked eye, making it ideal for tactical applications like SWAT, special ops, and border security.

While thermography doesn't require extra infrared light, it's good to understand the difference between long-wavelength infrared and near-infrared.

LightpathOptics

The FOM120 series general-purpose power meters are great for both premise and outside plant applications. These units are ideal for measurement of optical ...

Revenue for fiscal 2024 was approximately $31.7 million, a decrease of approximately $1.2 million, or 4%, as compared to approximately $32.9 million in the same period of the prior fiscal year. The decrease was primarily driven by a decrease in sales of visible components, partially offset by increases in sales of IR components and engineering services. Revenue among our product groups for fiscal 2024 was as follows:

Date: Thursday, September 19, 2024Time: 5:00 p.m. (ET)Dial-in Number: 1-877-317-2514International Dial-in Number: 1-412-317-2514Webcast: 4Q24 Webcast Link

Round, flexible architectural light that bends and emits light in all directions. Water resistant with precision light quality and full diffusion for a dotless ...

Lightpath technologiesgeneral manager

Look to Littelfuse for lightning protection, transient voltage surge suppression, rectification, and power factor correction solutions for LED lighting ...

This establishment offers a variety of games, like slots and table games, for the thrill-seeking gambler. It's a place where luck meets excitement. Welcoming to ...

Mightex has microscope LED light sources to produce homogeneous, high-intensity, wide-field illumination under any upright or inverted microscope.

Gross margin in the fourth quarter of fiscal 2024 was approximately $2.5 million, a decrease of $0.6 million, or 18%, as compared to the same quarter of the prior fiscal year. Total cost of sales was approximately $6.1 million for the fourth quarter of fiscal 2024, compared to approximately $6.6 million for the same quarter of the prior fiscal year. Gross margin as a percentage of revenue was 29% for the fourth quarter of fiscal 2024, compared to 32% for the same quarter of the prior fiscal year. The decrease in gross margin as a percentage of revenue is primarily due to the overall decrease in revenue, resulting in a lower contribution to our fixed manufacturing costs. Sequentially, gross margin improved from 21% in the third quarter of fiscal 2024 as we moved past the inventory revaluation which negatively impacted that quarter.

LightPathLenses

To supplement our consolidated financial statements presented in accordance with U.S. GAAP, we provide additional non-GAAP financial measures. Our management believes these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may or could, have a disproportionally positive or negative impact on results in any particular period. Our management also believes that these non-GAAP financial measures enhance the ability of investors to analyze our underlying business operations and understand our performance. In addition, our management may utilize these non-GAAP financial measures as guides in forecasting, budgeting, and planning. Any analysis on non-GAAP financial measures should be used in conjunction with results presented in accordance with GAAP. A reconciliation of these non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP is presented in the tables below.

LightPath Technologies, Inc. (NASDAQ: LPTH) ("LightPath," the "Company," or "we"), a leading provider of next-generation optics and imaging systems...

LightpathAltice

EBITDA* for the quarter ended June 30, 2024 was a loss of approximately $1.3 million, compared to income of $0.1 million for the same period of the prior fiscal year. The decrease in EBITDA in the fourth quarter of fiscal year 2024 was primarily attributable to the decrease in revenue and gross margin, coupled with increases in SG&A and Other expenses, net, which expense increases primarily related to non-recurring items.

Selling, general and administrative ("SG&A") costs were approximately $3.6 million for the fourth quarter of fiscal 2024, an increase of approximately $0.6 million, or 20%, as compared to the same quarter of the prior fiscal year. The increase in SG&A for the fourth quarter of fiscal 2024 is primarily due to an increase in wages, including non-recurring executive severance costs of $0.1 million, and an increase in legal and consulting fees related to business development initiatives. We also incurred additional legal and professional fees associated with the previously disclosed Delaware chancery court proceedings related to various corporate matters.

Lights Lacquer by Kathleenlights. Cruelty-free, 12 free & made in the United States, Lights Lacquer offers a premium lacquer formula and one-of-a-kind ...

LightPath's President and Chief Executive Officer Sam Rubin stated, "Looking back at fiscal 2024, LightPath took significant steps in our strategic plan to position the Company for growth. We continued transitioning from a component provider to a custom thermal imaging solutions provider while pursuing our three pillars of growth: automotive, defense, and camera solutions."

Our total backlog as of June 30, 2024, was approximately $19.3 million, a decrease of 11%, as compared to $21.7 million as of June 30, 2023. The decrease in backlog during fiscal 2024 as compared fiscal 2023 is primarily due to fiscal 2024 shipments against the prior period backlog under several annual and multi-year contract renewals. The timing of multi-year contract renewals are not always consistent and, thus, backlog levels may increase substantially when annual and multi-year orders are received and decrease as shipments are made against these orders. We anticipate that our existing annual and multi-year contracts will be renewed in foreseeable future quarters. The reduction in backlog as a result of these shipments during fiscal 2024 were partially offset by the following: (i) a significant contract renewal (represented a 40% increase in dollar value as compared to the previous order) for advanced infrared optics for a critical international military program; and (ii) a significant contract awarded to Visimid by Lockheed Martin in December 2023. In previous years we have typically received a significant contract renewal during our second fiscal quarter from our largest customer for infrared products made of Germanium. However, as previously disclosed we have decided to reduce the amount of optics we produce from Germanium, both to reduce our risk of supply chain disruption and, more importantly, to work with customers to convert their systems to use optics made of our own BlackDiamond materials. As such, in the second quarter of fiscal 2024 we did not book our typical annual renewal order for Germanium optics with this customer. Instead, we continue to work with this customer, as well as other customers, to convert their systems to use BlackDiamond optics, which we believe will result in future orders to replace the orders for Germanium-based optics.

ORLANDO, Fla., Sept. 19, 2024 /PRNewswire/ -- LightPath Technologies, Inc. (NASDAQ: LPTH) ("LightPath," the "Company," or "we"), a leading global, vertically integrated provider of thermal imaging cores, custom optical assemblies, photonics and infrared solutions for the industrial, commercial, defense, telecommunications, and medical industries, today announced financial results for its fiscal 2024 fourth quarter and full year ended June 30, 2024.

Use the Ring app to see what's happening, turn on the lights, speak to ... Good flood light + security camera for a residential house. It’s really ...

LightPath Technologies, Inc. (NASDAQ: LPTH) ("LightPath," the "Company," or "we"), a leading provider of next-generation optics and imaging systems...

This press release includes statements that constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "forecast," "guidance," "plan," "estimate," "will," "would," "project," "maintain," "intend," "expect," "anticipate," "prospect," "strategy," "future," "likely," "may," "should," "believe," "continue," "opportunity," "potential," and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements are based on information available at the time the statements are made and/or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or suggested by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the impact of varying demand for the Company products; the ability of the Company to obtain needed raw materials and components from its suppliers; general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; geopolitical tensions, the Russian-Ukraine conflict, and the Hamas/Israel war; the effects of steps that the Company could take to reduce operating costs; rising inflation and increased interest rates, which diminish capital market cash flow and borrowing power; the inability of the Company to sustain profitable sales growth, convert inventory to cash, or reduce its costs to maintain competitive prices for its products; circumstances or developments that may make the Company unable to implement or realize the anticipated benefits, or that may increase the costs, of its current and planned business initiatives; and those factors detailed by LightPath Technologies, Inc. in its public filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on 10-Q. Should one or more of these risks, uncertainties, or facts materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by the forward-looking statements contained herein. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Except as required under the federal securities laws and the rules and regulations of the Securities and Exchange Commission, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

"Our strategic decision to focus on defense began to pay dividends as we announced our work with Lockheed Martin on a next-generation missile project. The work on this project will influence LightPath over the long term, and should Lockheed secure the project, it would be a transformative opportunity for the Company. Since being chosen for this project, we have continually hit our milestones and have now qualified to ship air worthy units."

CablevisionLightpath

Infrared is visible to the naked eye up to around 850nm and appears as a faint deep red/purple glow. IR becomes invisible to the naked eye above 850nm.

Infrared light opens up a whole new world of possibilities for law enforcement and first responders. It's essential to understand what your needs are when using infrared light.

"Throughout the year, we demonstrated the potential of our thermal imaging cameras through each introduction of application-specific variations. We introduced new versions of the Mantis camera, including a high-temperature furnace monitoring camera and a long-range detection camera, as well as AI-enabled thermal cameras. Each one of these cameras introduces capabilities previously unavailable within a single camera. The development of these specially tuned cameras was enabled by our acquisition of Visimid in July 2023."

LightPath will host an audio conference call and webcast on Thursday, September 19, 2024, at 5:00 p.m. ET to discuss its financial and operational performance for its fiscal 2024 fourth quarter and full year.

Night vision devices or goggles work by gathering existing ambient light. This light, which is made up of photons, is converted to electrons. The electrons are then amplified to a much greater number. The amplified electrons are then converted into visible light on a screen, resulting in a relatively bright image otherwise invisible to the naked eye. (Credit: ATN)

Lightpathfiber

To provide investors with additional information regarding financial results, this press release includes references to EBITDA, which is a non-GAAP financial measure. For a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure calculated in accordance with GAAP, see the table provided in this press release.

Key facts to remember – 850nm helps identify bruising and abuse for forensics, and 940nm is ideal for illuminating night vision devices and goggles.

Participants are recommended to dial-in or log-on approximately 10 minutes prior to the start of the event. A replay of the call will be available approximately one hour after completion through October 3, 2024. To listen to the replay, dial 1-877-344-7529 (domestic) or 1-412-317-0088 (international), and enter conference ID #7324919.

Cash provided by operations was approximately $0.5 million for fiscal 2024, compared to cash used in operations of approximately $2.8 million for the prior fiscal year. The increase in cash flows from operations during fiscal year 2024 is primarily due decreases in accounts receivable and inventory, due to lower sales in fiscal year 2024, as compared to fiscal year 2023. Cash used in operations for fiscal year 2023 was primarily due to an increase in accounts receivable, due to higher sales in the fourth quarter of fiscal year 2023, and an increase in inventory during the second half of fiscal year 2023. The cash outflow for accounts payable and accrued liabilities for fiscal year 2023 was largely due to the previously described events that occurred at our Chinese subsidiaries, for which certain expenses were accrued as of June 30, 2021 and paid during fiscal years 2022 and 2023.

When 940nm infrared light illuminates the night vision device scene, the image is brighter and clearer for the operator to see.

LightPath Technologies, Inc. (NASDAQ: LPTH) is a leading global, vertically integrated provider of optics, photonics and infrared solutions for the industrial, commercial, defense, telecommunications, and medical industries. LightPath designs and manufactures proprietary optical and infrared components including molded glass aspheric lenses and assemblies, custom molded glass freeform lenses, infrared lenses and thermal imaging assemblies, fused fiber collimators, and proprietary BlackDiamond™ ("BD6") chalcogenide-based glass lenses. LightPath also offers custom optical assemblies, including full engineering design support. The Company is headquartered in Orlando, Florida, with manufacturing and sales offices in Dallas, Texas, Latvia and China.

Ms.Cici

Ms.Cici

8618319014500

8618319014500