Nobody Cares About Your Career: Why Failure Is Good, ... - erika ayers badan

Anything that impacts a company's stock price will also impact its market cap. For example, if a company is perceived as successful, perhaps due to new products or growing profits, investors may want to get in on the action and buy shares. The price of that company's stock may then rise, driving the market cap up along with it. On the flip side, if a company starts losing money or faces a major scandal, then investors may start selling shares—taking the stock price and market cap lower.

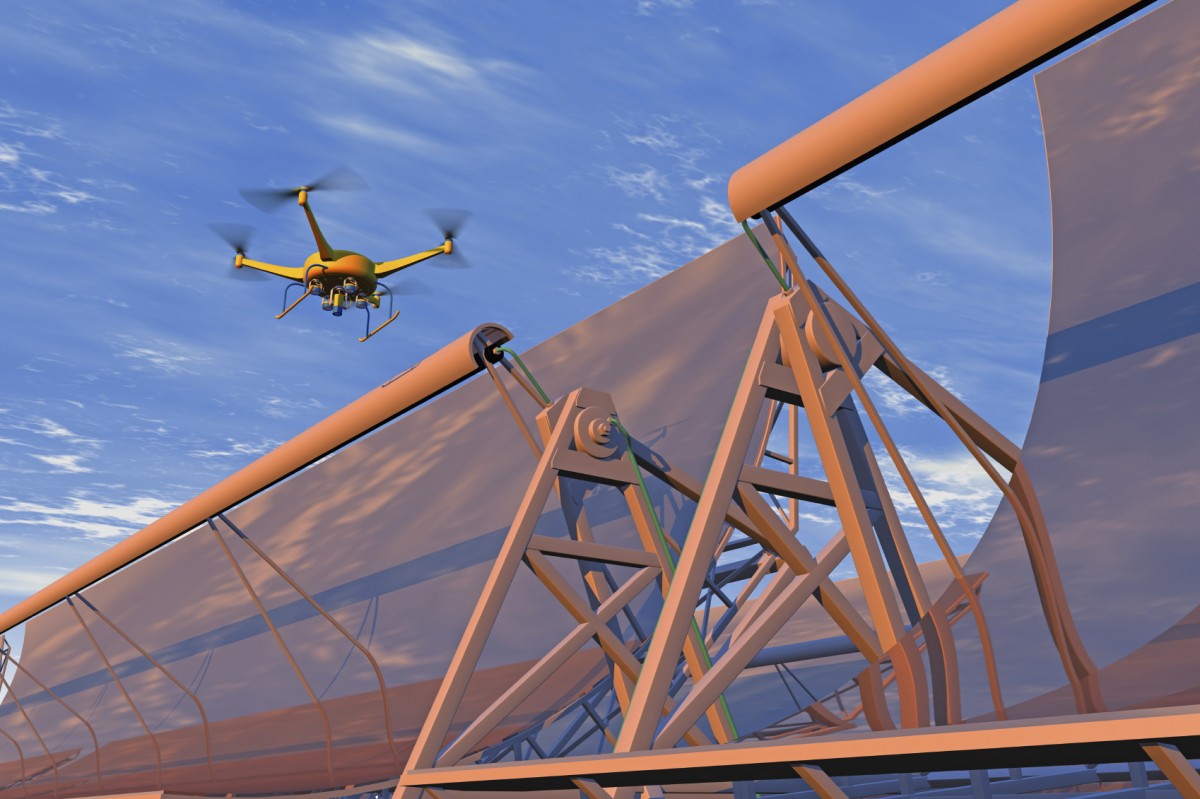

Regulation related to unmanned aerial vehicles or UAV’s is a hot topic in aviation circles. The term “UAV” is used to refer to both autonomous drones and vehicles which are piloted remotely by military or civilian personal. While talk about UAV’s may seem recent, it turns out that UAV’s have been around since before the Wright Brothers’ iconic flight.

When was drone camera invented

In addition to those 3 main categories, there are 2 more categories at the most extreme ends of the scale. The largest companies, such as those with market caps of $200 billion or more, are often called mega-caps. And the smallest companies, such as those with values of less than $250 million, are typically considered micro-caps.

As pilotless aircraft become more common in the civilian space, they are facing many regulatory battles ahead, as well as safety and privacy concerns from the general public. New uses for UAV’s are constantly being developed. It’s only a matter of time before they become a regular part of our everyday life.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

Large-cap companies generally have a market cap of $10 billion or more. These are often well-established companies. Some large-cap companies might be mature businesses that pay dividends. Large-cap companies, as a group, may pose less risk and volatility to investors than smaller companies. But when companies become very large their growth rates can slow, so they might also offer less growth potential than some smaller companies.

Market cap is also important when building a portfolio. Understanding market cap may help you decide where a stock or fund fits into your asset allocation, plus how much of it you want to own. For instance, if you've decided on an asset allocation of 70% stocks and 30% bonds, you might spread that 70% among companies of various market capitalizations, to align with your risk tolerance.

More recently, the U.S. border patrol has been using drones to patrol the border with Mexico, and the FAA recently approved the use of drones in the search for survivors in the wake of natural disasters. Retailers such as Amazon have also considered employing drones for making home deliveries. In 2015 alone, it’s estimated that about one million recreational drones were sold to civilians.

When were moderndronesinvented

A company's market cap might help give you a sense of how risky its stock is. Larger companies are often more established and have less volatile stocks. Smaller companies may have more volatile stocks, but in some cases may be able to grow faster than very large companies. And of course, many specific companies will defy those generalizations.

Market cap, or market capitalization, is a simple investing concept that can help you better understand a company's market value. Knowing a company's market cap might help you gauge its risks and help you decide whether a stock or fund belongs in your portfolio. And if it earns a place in your investment lineup, market cap could help you decide how much you should own.

Market cap is the total dollar value of a company's outstanding shares of stock. For example, if a company has 1 million shares of outstanding stock and the stock currently trades at $50 per share, then its current market cap is $50 million. Market cap fluctuates with a company's share price, and so can change over time or even over the course of a single trading day.

Arguably, the first UAV’s employed for military purposes were unmanned balloons released over Venice in 1849. The balloons were packed with explosives and aimed toward the city. But as you’d expect, unmanned balloons were at the mercy of the wind, and few hit their target. The first weather balloons for measuring conditions in the atmosphere went up not long after, in 1896.

How long have drones been aroundthe world

It was just after World War I that the first controllable unmanned aircraft took to the skies. One of these was the Ruston Proctor Aerial Target, which was operated using rudimentary radio control in 1916. UAV development was primarily driven by military concerns, as aircraft technology had leapt forward during WWI. The Hewitt-Sperry Automatic Airplane made its own first flight around this time, controlled by gyroscopes.

First drone camera in the world

It's a back-of-the-envelope way of putting a number on a company, but it's just one way of measuring this. Imagine that you were estimating the value of a country. You could measure it by the dollar value of the economy, or the size of the population, or the square acreage of the land. Measuring a company is similarly complex, but market cap is a simple and popular way of estimating its value and size quickly.

Small-cap companies generally have market caps between $250 million and $2 billion. Small caps are often younger companies that are aiming to grow their businesses quickly. When small caps are successful, they might be able to show fast growth and strong stock gains. But because these companies may be less stable, less well-established, and have less access to cash, they might also be more vulnerable to downturns or even failure, and so can come with greater risk.

History ofdronestimeline

Within the stock portion of your portfolio, you might consider diversifying among large-cap, mid-cap, and small-cap companies. That's because there might be times when one of these groups performs well, but another doesn't. (Read more in our guide to diversification.)

Most major market-cap-weighted stock indexes, like the S&P 500® and Russell 2000 use free-float market cap in determining how large of a weighting to assign companies.

Who inventeddronesWikipedia

When diddronesbecome popular

With a solid understanding of market cap now under your belt, here are some ways to consider using it as you're researching investments and constructing your portfolio.

Free-float market cap considers only shares that are considered to be freely available for trading in the market, and is a common measure used in index weightings. Free-float market cap takes market cap and subtracts for shares that are unlikely to be traded. This typically means subtracting shares held by officers and directors of the company, those held by another publicly traded company, and those held by certain other entities.1

In the early 1930s, the British created the DH.82B Queen Bee, a radio controlled aircraft which was a modified De Havilland Tiger Moth biplane trainer. The term “drone” is thought to have derived from this early unmanned aircraft. By 1936, the U.S. Navy, which was also researching radio-controlled aircraft, also started using the term “drone” to describe them.

Investors interested in researching investment options across various market-cap segments can use Fidelity's Stock Screener, Mutual Fund Evaluator, or ETF/ETP screener.

When weredronesfirst used in war

Throughout the Cold War and Vietnam, drones were used for aerial reconnaissance missions. Many were launched from aircraft, initially, and controlled by radio. Few of these drones had actual landing gear, and most were retrieved after deploying parachutes to soften their descent. In the mid-80’s the Israeli Air Force used drones to devastating effect against the Syrian Air Force, ushering in a new era of drones used not only for reconnaissance, but also as decoys and signal jammers.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Mid-cap companies are those that fall between large- and small-cap companies, and are generally considered to be companies with a market cap between $2 billion and $10 billion. As a group, their risk level is typically also considered to be a middle ground between large- and small-caps, with potentially less risk than small caps but more than large caps.

Additionally, Charles Kettering of Dayton, Ohio was commissioned by the United States Army to create an unmanned flying missile that could hit a target up to forty miles away. Aviation pioneer Orville Wright was an aeronautical consultant. Together, the two created a flying missile that could fly at 50 miles an hour and hit a target up to 75 miles away. As with many project commissioned for the war effort, however, it was not completed until after the conflict has ceased.

Successful investing starts with a well-thought-out and well-rounded plan. Whether you do the research yourself to choose an asset allocation, use an online tool to help guide you, or work with a financial advisor to build one, it's important to have a strategy that's appropriate for your needs and situation. The 3 key concepts of risk tolerance, risk capacity, and time horizon can help guide you to a suitable plan. (Read more about the 3 keys to choosing investments.)

Companies are generally sorted into 3 main market-cap segments: large-cap, mid-cap and small-cap. Exactly where you draw the lines between these 3 groups isn't set in stone, and some investors may have different opinions as to what number qualifies a company for which group. But the following are commonly used definitions for each group.

For instance, say a company has 12 million shares currently selling at $32 per share. That comes out to a market cap of $384 million, which puts this company in the small-cap category today. Now, if the company grows and its share price eventually increases to $184, then its market cap increases to $2.208 billion. At that point, it might start to be considered a mid-cap company.

If you're building a portfolio yourself, it can be a lot of work to analyze and choose individual companies to invest in, plus assemble a well-diversified portfolio of individual stocks. ETFs and mutual funds might be able to help you achieve your targeted asset allocation, including your desired allocation among market-cap segments, without having to research hundreds of companies yourself.

Ms.Cici

Ms.Cici

8618319014500

8618319014500