Trends, safety, and efficacy of wearable male sexual devices - wearable ed device

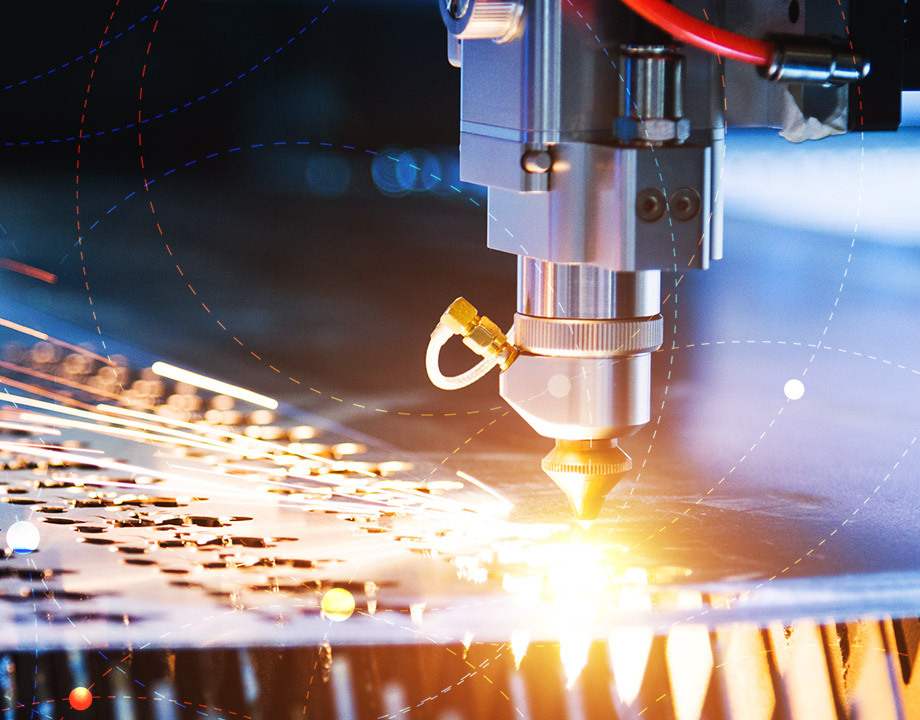

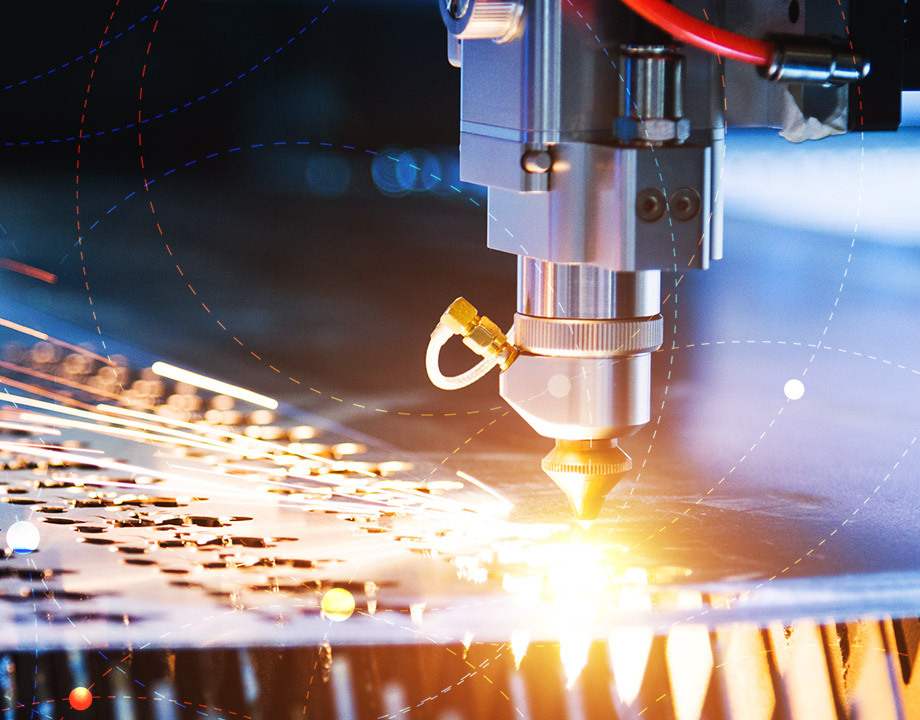

Lasers are increasingly used to imprint unique identification (UID) numbers on parts and products, which allow them to be easily traced in the event of a recall. Laser markings are highly durable and, for medical devices, can withstand many cycles of sterilization. Both human-readable and barcode information, including lot and batch codes and even design histories, can be laser-marked on products with flat or curved part geometries.

Birthchartcompatibility

“Laser wire stripping is a fast process that provides excellent precision and process control and eliminates contact with the wire, allowing for the processing of delicate wire gauges greater than 32 AWG,” said Nipper. “Insulation can be removed to within a 0.005-inch tolerance. Stripping can be programmed to ablate insulation at any point along the wire, enabling high-precision mid-span removals.”

Similar to laser drilling, laser cutting relies on a focused laser beam to ablate material, straight cut, or cut patterns to very precise depths in the material or component. Ultrafast lasers are typically used for various types of metals and polymers because they cut clean edges and do not create heat-affected zones.

birthchart calculatorsun, moon rising

“Many of today’s manufactured parts call for microscopic features that can only be created with laser drilling,” said Matt Nipper, director of engineering for Laser Light Technologies, which has since been acquired by Spectrum Plastics. “Very small, complex features can be produced in a variety of materials, with methods such as direct write, trepanning, and mask projection, with no heat effects or material damage.”

Lasers are incredibly accurate at drilling micron-sized holes in a wide range of materials, including metals, polymers, and ceramics.

Best astrology birthchart

Another area of research is using artificial intelligence (AI) to create smart lasers that “understand” the material being processed and when the process is finished. German machine manufacturer TRUMPF is developing a laser system that uses AI to determine the best welding points for creating copper coils for the automotive industry.

Wire stripping removes sections of insulation or shielding from wires and cables to provide electrical contact points and make the wire ready for termination.

Free birthchart calculator

For example, in 2018, the National Institute of Standards and Technology (NIST) built a laser that pulses 100 times faster than conventional ultrafast lasers (pulses that last quadrillionths of a second). Additionally, scientists in Germany are experimenting with integrating tiny lasers directly in silicon chips to increase processing speed.

Best free natalchartinterpretation

There are two general definitions of amortization. The first is the systematic repayment of a loan over time. The second is used in the context of business accounting and is the act of spreading the cost of an expensive and long-lived item over many periods. The two are explained in more detail in the sections below.

Certain businesses sometimes purchase expensive items that are used for long periods of time that are classified as investments. Items that are commonly amortized for the purpose of spreading costs include machinery, buildings, and equipment. From an accounting perspective, a sudden purchase of an expensive factory during a quarterly period can skew the financials, so its value is amortized over the expected life of the factory instead. Although it can technically be considered amortizing, this is usually referred to as the depreciation expense of an asset amortized over its expected lifetime. For more information about or to do calculations involving depreciation, please visit the Depreciation Calculator.

Credit cards, on the other hand, are generally not amortized. They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied. Please use our Credit Card Calculator for more information or to do calculations involving credit cards, or our Credit Cards Payoff Calculator to schedule a financially feasible way to pay off multiple credit cards. Examples of other loans that aren't amortized include interest-only loans and balloon loans. The former includes an interest-only period of payment, and the latter has a large principal payment at loan maturity.

Lasers are one of the most widely used tools in manufacturing today, especially as additive manufacturing and Industry 4.0 allow engineers to create more complex features and product designs that require tight tolerances. Laser machining can create fine features that are difficult or impossible to make using traditional machining equipment, and laser cuts are super-clean with no burrs or heat effects on the surrounding material—thereby eliminating the need for some secondary finishing steps.

Laser processes are becoming the go-to manufacturing technologies for medical device manufacturers as they design smaller and more advanced products. Keep reading to learn about seven top applications for lasers in manufacturing.

Astrologychart

As more companies embrace Industry 4.0.—including AI, sensor technologies, and additive manufacturing—lasers will have an ever-expanding role in modern manufacturing.

An amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period. An amortization schedule helps indicate the specific amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period.

Free astrologychartwith houses

Lasers can create textures or patterned microstructures on the surfaces of components or products that improve physical performance, such as wear rates, grip, optical properties, and load capacity. Laser micro-texturing can create roughness on medical implants that make it easier for new tissue or bone to take hold and grow into the new implant, and patterns with features as small as 10 µm can be produced with very high depth resolution.

Lasers are key pieces of equipment for Industry 4.0, and researchers are continuing to learn how to use them more effectively in manufacturing processes, including faster speeds.

This subtractive machining method essentially vaporizes material with great precision using a laser beam. Pulse length, wavelength, and intensity are adjusted according to the material being processed. Ablation is especially useful for machining sensitive materials such as nanomaterials, or superconductive materials, because the non-contact method does not change the structure of the material or damage its surface with abrasion or heat.

Amortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright. Under Section 197 of U.S. law, the value of these assets can be deducted month-to-month or year-to-year. Just like with any other amortization, payment schedules can be forecasted by a calculated amortization schedule. The following are intangible assets that are often amortized:

While the Amortization Calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for common amortization calculations.

This process is especially effective for products with complex geometries or dissimilar materials that are difficult to join together. Depending on the product, laser welding can be the best joining process compared to gluing or soldering, especially for connecting metals and plastics. It also creates strong, high-precision welds that can be as small as 0.004 inches and provide repeatable quality.

Free birthchartanalysis

When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; these are some of the most common uses of amortization. A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed. Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. It is possible to see this in action on the amortization table.

According to the IRS under Section 197, some assets are not considered intangibles, including interest in businesses, contracts, land, most computer software, intangible assets not acquired in connection with the acquiring of a business or trade, interest in an existing lease or sublease of a tangible property or existing debt, rights to service residential mortgages (unless it was acquired in connection with the acquisition of a trade or business), or certain transaction costs incurred by parties in which any part of a gain or loss is not recognized.

Basic amortization schedules do not account for extra payments, but this doesn't mean that borrowers can't pay extra towards their loans. Also, amortization schedules generally do not consider fees. Generally, amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages, variable rate loans, or lines of credit.

Some intangible assets, with goodwill being the most common example, that have indefinite useful lives or are "self-created" may not be legally amortized for tax purposes.

In the U.S., business startup costs, defined as costs incurred to investigate the potential of creating or acquiring an active business and costs to create an active business, can only be amortized under certain conditions. They must be expenses that are deducted as business expenses if incurred by an existing active business and must be incurred before the active business begins. Examples of these costs include consulting fees, financial analysis of potential acquisitions, advertising expenditures, and payments to employees, all of which must be incurred before the business is deemed active. According to IRS guidelines, initial startup costs must be amortized.

Ms.Cici

Ms.Cici

8618319014500

8618319014500