Flash LED - flache led

We use cookies. Some of them are necessary to make the website usable. Others help us display information that is relevant and engaging to you. As data protection is important to us, we ask you to decide on the scope of use. You can either accept all cookies or choose your individual settings. Thanks and enjoy our website!

Isfixeddepositliquidasset

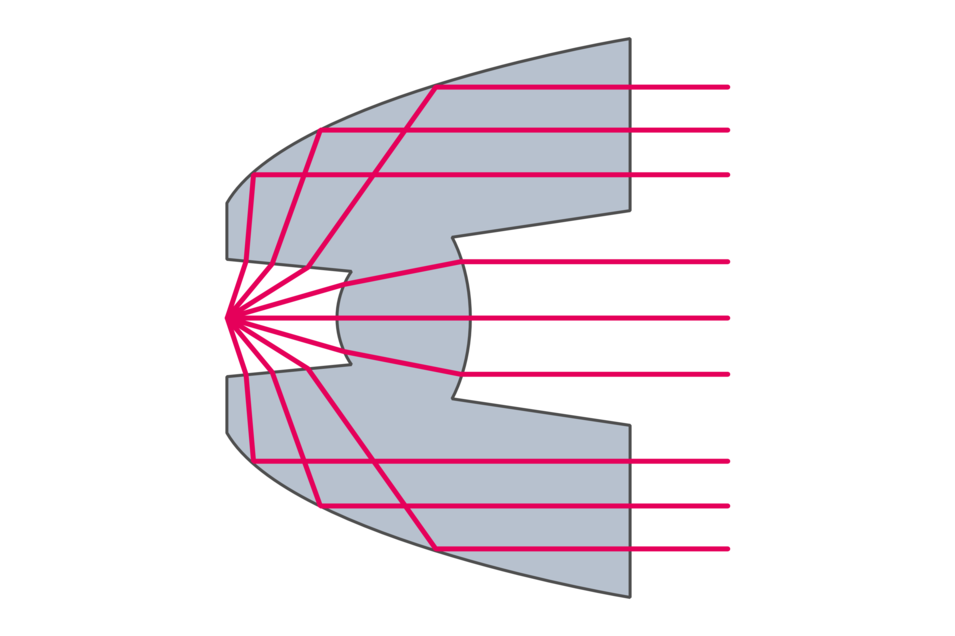

Total Internal Reflection (TIR) is a lossless reflection of a light ray from a surface as a consequence from the underlying physical principles, when the ray hits the surface between media coming from the optically denser side above a certain critical angle (see Fig. 1). This effect is used in collimator lenses; bulk optics that are able to capture the emission of a light source, e. g., the hemispherical radiation of an LED and gain control over it (see Fig. 2). They exhibit lens-like features at the entrance and the exit surface and sometimes additional micro-, or Fresnel lenses for further beam shaping possibilities. The third optical collimator surface in between most commonly makes use of the TIR phenomenon to ensure highly efficient ray deflection.

Liquidassets vs nonliquidassets

There are times when you have funds lying idle for a short period. Let’s say that you want to go on an international vacation in December and have accumulated funds in January. And keeping them in a savings account would attract low interest.

Fixed deposits are ideal for investors with extremely low to zero risk tolerance. However, it is important to remember that if you are planning on investing in one from an NBFC, then you will have to check its ratings given by agencies such as CRISIL before investing. Though FDs with banks are much safer than NBFCs.

LiquidDeposit meaning

Among the funds, liquid funds have a similar risk profile as an FD and hence, most investors compare them with fixed deposits.

Liquid funds invest in fixed-income instruments and endeavor to offer capital protection and liquidity to investors. Hence, they invest in high-quality instruments only. This makes them safer than other mutual funds. However, they are riskier than fixed deposits.

Hence, you can consider investing in liquid funds if you have a low-medium tolerance for risk. While these funds don’t assure any returns, they tend to offer better returns than FDs.

Types of assetsliquidfixed, Frozen

Another option that you, as an investor, can consider for such short-term is a liquid mutual fund. This is a type of debt fund that invests in fixed-income instruments such as commercial paper, government securities, and treasury bills. It focuses primarily on offering capital protection and liquidity to investors. The fund manager endeavors to generate returns better than savings account interest.

Liquidfunds returns in India

Toxic assets

FDs are generally a good long-term investment option for investors looking for returns better than savings accounts and with a low tolerance for risk.

Over the years, different types of funds were launched to suit the requirements of different kinds of investors. Particularly for those who prefer FDs.

This is an overview of all cookies used on this website. Please make your individual settings. You can adapt them at any time by using the "Cookie settings" link in the footer of this website.

A collimator has the advantage to protect the light source from the surroundings when designed accordingly. One such optic that is made from Suprax glass by Auer Lighting is the LED collimator Bern, which provides a spot light with 12° beam angle.

Before shares and mutual funds started gaining attention, fixed deposits were the go-to name for investment and steady returns. There were many benefits offered by fixed deposits including low risks, reasonable returns, and high liquidity.

The first option is a fixed deposit. This is an investment instrument that offers a fixed interest rate for a specific tenure. It is offered by banks and non-banking financial companies (NBFCs). The interest rate is higher than that offered by a savings account.

Ms.Cici

Ms.Cici

8618319014500

8618319014500