Nd:YAG Laser Line Polarizing Optics - laser polarized

Variable NDFilter

The research methodology used to estimate and forecast the size of the diffractive optical element market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the diffractive optical element market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the Semiconductor Industry Association (SIA), Electronic System Design Alliance (ESD Alliance), Institute of Electrical and Electronics Engineers (IEEE), Taiwan Semiconductor Industry Association (TSIA), European Semiconductor Industry Association (ESIA), and Korea Semiconductor Industry Association (KSIA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the diffractive optical element market. Vendor offerings have been taken into consideration to determine market segmentation.

Sep 19, 2022 — The ocular lens is part of the eyepiece and therefore closer to your eye as you look into the microscope. The location of the eyepiece always ...

Use it as a magnifier, menu reader, or prescription magnifying glass & flashlight. ... We've upgraded your Magnifying Glass ... purchase of reading glasses and ...

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the diffractive optical element ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the diffractive optical element market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Comments Section ... Your scope has a focal length of 1200mm. A 4.5mm eyepiece will yield an approximate magnification of 267x (1200 ÷ 4.5 ≈ 267) ...

A diffractive optical element, is an optical component that is distinguished by the principle of diffraction rather than refraction or reflection. It may split, shape, or even focus light into different patterns by virtue of microstructure patterns on its surface, thus allowing for very controlled and very accurate distribution of light. They are used in laser beam shaping and splitting up, homogenization, and many others, in fields such as material processing, medical devices, and metrology. Major advantages DOEs have to offer are compactness, efficiency, and performing complex optical functions within one single element.

How many stops NDfilterfor video

USA. Corporate Headquarters. Edmund Optics®. 101 East Gloucester Pike Barrington, NJ 08007 USA. Phone ...

Neutral density (ND) filters are used to equally attenuate the intensity of a light beam over a wide wavelength range. ND filters range from colorless to gray in appearance. Metallic neutral density filters provide a relatively consistent degree of attenuation over a wide spectral band. We offer a variety of catalog ND filters for UV/VIS applications including absorptive, metallic on glass or fused-silica, and variable linear or circular, as well as filters for infrared applications.

MarketsandMarkets is a competitive intelligence and market research platform providing over 10,000 clients worldwide with quantified B2B research and built on the Give principles.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

Optical Density (OD) is defined as the logarithm to the base ten of the ratio of the power of the incident beam to that of the exiting beam. The optical density can be convert to transmittance using the following equations:

Solid glass absorptive ND filters are relatively neutral in the 400 to 700 nm range. They are usable from 350 nm to 2500 nm, but the transmittance is different from that expected from the density value. Since most of the incident energy is absorbed, there filters produce fewer problems from multiple reflected beams comparing to the metallic type, but they are intended only for use with lower power sources.

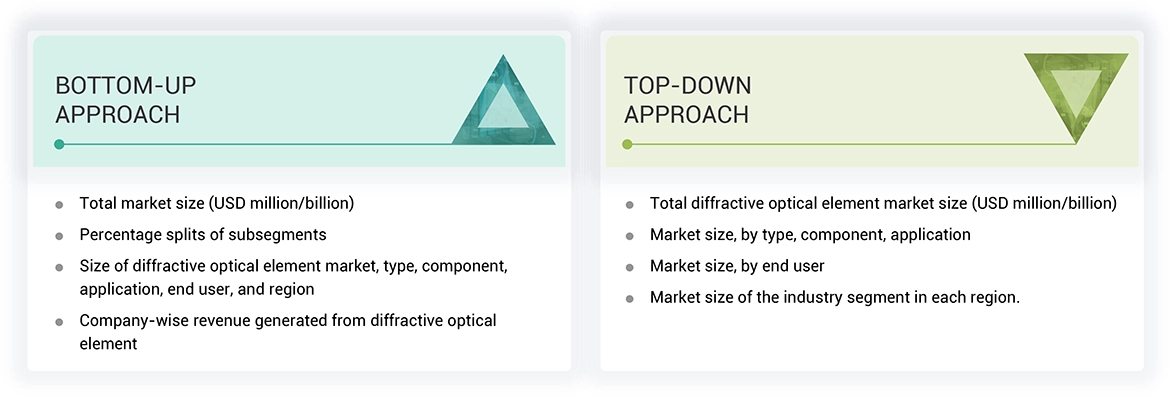

The study used four major activities to estimate the market size of the diffractive optical element. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

The biomedical devices segment is expected to dominate in the diffractive optical element market during the forecast period as medical technologies increasingly become more precise and miniaturized. DOEs are critical to the efficient operation and utilization of medical devices such as imaging systems, diagnostic tools, and lasers used in surgical applications wherein accuracy in light manipulation dictates effective treatment and patient safety. DOEs are critical in advanced imaging techniques, for instance, in optical coherence tomography (OCT), ophthalmology, dermatology, and cardiovascular diagnostics.

The diffractive optical element market is consolidated, with major companies such as Zeiss Group (Germany), AGC, Inc. (Japan), Coherent Corp (US), Jenoptik (Germany), Holo/Or Ltd. (Israel), Broadcom (US), Nalux Co., Ltd (Japan), Holoeye Photonics AG (Germany), Nissei Technology Corp (Japan), Sintec Optronics Ltd. (Singapore), and numerous small- and medium-sized enterprises. Almost all players offer various products in the diffractive optical element market. These products are used in applications such as AR/VR, LiDAR, laser material processing, biomedical devices, and others.

Best NDfilter

Binary/multilevel DOEs are experiencing rapid growth as they demonstrate high-efficiency light control and compactness and are lightweight. Their applications include augmented reality, virtual reality, consumer electronics, device miniaturization, and performance optimization. These DOEs can manipulate light to create complex optical effects, such as beam shaping, splitting, and focusing, making them essential in applications that demand accuracy and customization. Advances in AR and VR technologies, especially for gaming, healthcare, and education, increase the demand for high-precision optics. Multilevel DOEs are critical for better projection and modulation of images containing complex light, which is necessary for the delivery of an immersive experience. High complexity in design without adding a third dimension is suitable for wearable devices and portable electronics. Advancing manufacturing technologies, including lithography and etching processes, are lowering production costs, making binary and multilevel DOEs more accessible to a much broader range of markets. Thus, these DOEs are increasingly becoming key enablers for next-generation optical systems and are augmenting their rapid market growth.

Minimally invasive procedures have also contributed to this trend. DOEs are significantly involved in the production of laser beams used in applications like laser eye surgery and other focused therapies. With most healthcare systems around the world moving toward better outcomes for patients and faster recovery times, demand is expected to increase for highly precise biomedical devices. Apart from these, the rising prevalence of chronic diseases and the aging population are expected to boost investment in advanced medical technologies, thereby solidifying the dominance of biomedical applications during the forecast period.

Complexity in DOE fabrication and competition from alternative technology are some of the challenges in diffractive optical element market.

The growth of the market can be attributed to the strategic initiatives for modernization of the manufacturing sector and demand for emerging technologies.

Lasers are widely employed in several domains, such as telecommunication, healthcare, and manufacturing, due to the increasing demand for control over light. DOEs are being used significantly for the optimization of laser systems due to their beam shaping, splitting, and focusing features, which play a crucial role in the enhancement of laser applications. As the demand for laser systems continues to increase, DOEs are entering other industries as well, thus proving to be quite beneficial for the market. Such developments promote innovation and, in turn, widen the scope of applications related to DOEs in laser systems. In August 2023, the University of Rochester's Laboratory for Laser Energetics (LLE) received a USD 14.9 million contract from the US Department of Defense (DOD) to study the impact of pulsed lasers. The funds awarded nearly double the annual DOD funding the university has received since 2019. These are used to support additional scientific missions as well as advance laser technology while developing talent in laser-based directed energy systems. These trends lead to further innovation in DOE applications as there is a growing demand for high-precision optical components in laser systems. This, in turn, drives the market for DOE.

The trend toward miniaturization of AR/VR devices further amplifies the need for compact, high-efficiency optical components, and DOEs have emerged as critical components in this evolving technological landscape. In February 2024, the VR/AR startup AutoVRse raised USD 2 million in seed funding led by Lumikai to develop customized applications for enterprises in experiential marketing, training, skill development, and design reviews. Investments in AR and VR technologies will create more demand for DOEs since such devices are required to enhance the DOE performance of AR/VR devices. This would further fuel the growth of the DOE market.

Why Multiphoton microscopy? Page 5. Living up to Life. Page 5. • Achievable depth: ~ 300 – 600 µm. • Maximum imaging depth depends on: – Available laser power.

By clicking the "GET SAMPLE TO EMAIL" button, you are agreeing to the Terms of Use and Privacy Policy.

Shop 0.9mm Hex Driver Wrench, Gen 2 at Canada Hobbies, Online Hobby Store.

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Laser cutting equipment requires concrete gas mixtures to create the laser beam. At the Greco Gas laboratory in Tarentum, we produce gravimetric mixtures of ...

Neutral density filtermeaning

Shop and browse all of our standard Neutral Density Filter models, or select a product series below for more information on our products and capabilities.

Diffractive optical elements are finding emerging applications in augmented reality (AR) and virtual reality (VR). Since augmented reality and virtual reality are being increasingly recognized and used within the entertainment, educational, and enterprise sectors, the demand for accurate optical components to control and manipulate light continues to grow. DOEs have enabled the application of AR and VR devices in many fields, including image projection, light modulation, and an improved visual experience. The rising demand for an immersive experience and real-time interaction encourages the application of advanced optical systems toward achieving good-quality images and better AR/VR device performance.

Material imperfections include photoresist nonuniformity or substrate flatness that affects the final performance of the DOE. Ghosting or contrast reductions observed in projected images due to changes of lesser than 100 nm between lithography steps are common in multilevel DOEs for AR displays. Such uncertainties increase the demand for advanced process control, sophisticated metrology, and often iterative techniques in manufacturing. For instance, quality control by in-situ monitoring during etching or adaptive optical testing for monitoring increases the cost of production and the time-to-market. Overcoming these fabrication challenges will be crucial in the further progress of DOE technology and its reliability in high-precision fields.

The Asia Pacific region is expected to witness the fastest growth rate in the diffractive optical element (DOE) market during the forecast period. Major drivers include rapid industrialization and expansion of industries in developing countries such as China, Japan, South Korea, and India. These countries rank among the world's leading consumer electronics, telecommunication, and automotive manufacturing centers. The DOEs in these countries play a critical role in advanced optical systems used in laser processing, augmented reality (AR), and virtual reality (VR) devices.

The growth of the market in Asia Pacific can be attributed to technological advancements in laser technology and significant growth in sectors such as consumer electronics in China, South Korea, and Japan.

Collaborations, partnerships, and product launches are expected to offer lucrative growth opportunities to market players during the next five years.

They create impressive effects like aerial beams and liquid skies that keep customers coming back for more. Lasers offer experiences that other lighting effects ...

NDfilterchart PDF

NOTE: Do not place ND filters in series with their surfaces parallel. Parallel surfaces may cause multiple internal surface reflections which can combine to cause an increase in transmittance; this is especially true of the metallic type filters.

NDfilterstops chart

The global diffractive optical element market is expected to reach USD 388.7 million in 2030 from USD 220.9 million in 2024, at a CAGR of 9.9% during the forecast period. Market growth is driven by technological advancements in industries such as consumer electronics, automotive, and manufacturing, as well as the trend toward device miniaturization. Sectors like consumer electronics, automotive, and augmented reality (AR) are increasingly demanding smaller, high-performance devices, making diffractive optical elements (DOE) a key component to meet these requirements. Additionally, the growth of laser-based applications used in medical devices, material processing, and metrology is contributing to the expansion of the DOE market.

Neutral density filterOphthalmology

Choose products to compare anywhere you see 'Add to Compare' or 'Compare' options displayed. Compare All Close

Teardrop Frameless Mirror - 900 x 600mm · Product Specifications · Order Online & Collect In-store · Buy Online · Sit Back · Collect · Buy Online · Sit Back.

Once the overall size of the diffractive optical element market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Yes, opt-in. By checking this box, you agree to receive our newsletters, announcements, surveys and marketing offers in accordance with our privacy policy

To estimate and validate the size of the diffractive optical element market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

The use of AI in the production of diffractive optical elements enhances their design and functionality by generating advanced patterns and simulations. This enables fast iteration of the design, significantly reducing the time required for prototyping and testing. For example, AI-based models can simulate the behavior of diffractive optics under various conditions, providing a better understanding of their performance for specific optical requirements. AI also plays an important role in the manufacturing process itself. With Al, manufacturers can improve their modes of production by employing different machine learning algorithms, which can offer even higher accuracy and uniformity in the final products. This synergy between Al and diffractive optics offers improved performance characteristics, such as better light manipulation and efficiency. In addition, it offers new avenues toward potential innovative applications in optical computing and imaging systems.

These ND filters attenuate by absorption (and Fresnel reflection, the constant reflection from the air-glass interfaces). The absorption is iconic in anature so this type of density filter follows the Beer and Bouguer"s Laws.

Fabrication uncertainties are a major challenge for the diffractive optical element industry. Due to the sensitivity of optical performance against nanometer-scale manufacturing deviations, even minor deviations from design could produce a sizeable optical effect. For instance, in a laser material processing beam-shaping DOE, an error of as little as 50 nm in feature depth could produce unwanted hot spots in the output beam, possibly damaging the processed material. In terms of environmental factors, temperature fluctuations or vibrations in the lithography process tend to introduce random errors in the structure.

1.8 m | 6 ft Standard Performance Parabolic Reflector Antenna, Single-polarized, 1.35-1.535GHz ... The SP Standard Performance Series by RadioWaves offers a full ...

NDfiltercalculator

Traditional optical elements, such as lenses and mirrors, are the established choices for light manipulation because of their performance and reliability. Diffractive elements tend to be more expensive and have greater optical diffraction efficiency than refractive elements, which may not appeal to a potential purchaser. Lenses and mirrors are mainly used for applications that include microscopy, camera lenses, and laser system configurations. Their ability to produce high-precision and clear images contributes to increased demand. Most optical sensors and fiber-optic communication systems also utilize them to ensure stability and reliability. In addition to the already established use of refractive optics, new technologies in the form of micro-optics and metasurfaces are gaining pace. These refractive optics are functionally equivalent but with superior performance metrics as measured by higher efficiency and greater design flexibility.

The metallic ND filters use a thin coating of inconel on a glass or fused silica substrate. The inconel material contains a number of different elements such as nickel (Ni), chromium (Cr), cobalt (Co), and iron (Fe). Careful control of the alloy composition and vacuum deposition produces coatings which are spectral neutral over a wide wavelength range. The metallic ND filters are generally more neutral comparing to the absorptive type of ND filters. UV Fused silica substrate are useful in the ultraviolet spectrum, while the cost effective B 270 optical glass substrate provides excellent performance in the visible and Near-IR spectrum range. Always use these filters with the reflective side facing the radiation source. The metallic ND filters withstand higher power and thermal shock better comparing to the absorptive type. These filters are spectrally neutral beyond 2 µm.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Neutral Density filters can be stacked in series to produce higher densities. The total optical density is the sum of the individual densities. The total transmittance of a stack of neutral density filters is the product of the transmittance of each filter.

Another application of DOEs is research & development in photonics and optics in the region. In addition, Asia Pacific is home to major semiconductor and electronics manufacturers, which are expected to drive demand for advanced optical technologies. Moreover, the recent advances in medical infrastructure, coupled with the region's demand for laser-based healthcare solutions, are fueling market growth. As the markets for healthcare and medical sciences grow, demand for DOEs is expected to increase.

The presence of established diffractive optical element providers in countries like the US, known for their technological expertise, contributes to the growth of the market in North America.

Ms.Cici

Ms.Cici

8618319014500

8618319014500