CineStill 400D Film - Dynamic Range & Natural Tones - film range

One party expects the prices to rise, while the other expects the opposite. As a result, one counterpart stands to profit, and the other party bears the loss.

Infinity corrected objectiveprice

2. All other information, such as, the images, facts, statistics etc. (“information”) that are in addition to the details mentioned in the BFL’s product/ service document and which are being displayed on this page only depicts the summary of the information sourced from the public domain. The said information is neither owned by BFL nor it is to the exclusive knowledge of BFL. There may be inadvertent inaccuracies or typographical errors or delays in updating the said information. Hence, users are advised to independently exercise diligence by verifying complete information, including by consulting experts, if any. Users shall be the sole owner of the decision taken, if any, about suitability of the same.

Metaphase Technologies Inc. Metaphase has the world's largest selection of machine vision & specialty LED Illumination. We produce solutions that integrate ...

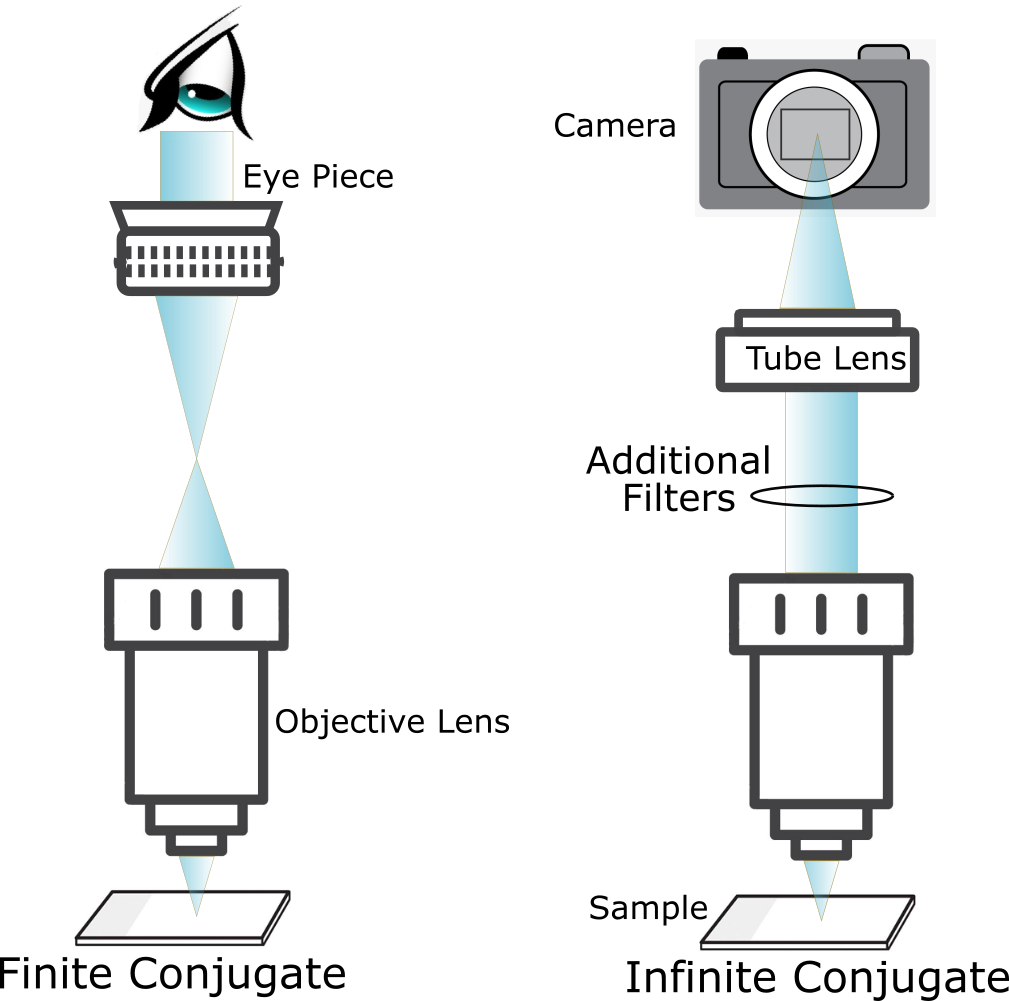

Klar’s microscopes use an infinite conjugate design for maximum flexibility. There are many locations to put additional filters and optical components to adapt the instrument for experimental needs. Additionally, Klar’s microscopes are compatible with standard infinity corrected objectives from various microscopy suppliers.

Infinity corrected objectivemicroscope

Futures options trading have profit potential but also involves risk in it. This kind of trading may not be for everyone. F&O, both have their own pros and cons.

Obligation: Futures contracts obligate the buyer to purchase and the seller to sell the underlying asset at a specified price and date in the future.

Future and option are two derivative instruments where the traders buy or sell an underlying asset at a pre-determined price. The trader makes a profit if the price rises. In case, he has a buy position and if he has a sell position, a fall in price is beneficial for him. In the opposite price movement, traders have to bear losses.

Edmunds Cars · Edmunds Top Rated 2024 · U-Drags · Videos · Shorts · These are the 2027 Scout Terra truck and Traveller SUV! · We Raced the Lucid Air Sapphire ...

On the other hand, in options contract, the buyer and seller of contract agree to transact in the underlying asset on a future date at a predetermined price. However, here the option buyer has the right but not the obligation to execute the contract on the expiry date.

Two parties enter a derivative contract where they agree to buy or sell the underlying asset at an agreed price on a fixed date. This fixed date is termed the expiry date in the stock market. The reason for entering such a contract is to hedge market risks by locking the price of an asset for a future date.

A future is a contract to buy or sell an underlying stock or other assets at a pre-determined price on a specific date. On the other hand, options contract gives an opportunity to the investor the right but not the obligation to buy or sell the assets at a specific price on a specific date, known as the expiry date.

Infinity corrected objectivewithout tube lens

Derivatives are instruments that do not have a value of their own. Thus, derivatives as the name suggests are indicative of the price of their underlying security as they help you take a position on your opinion of its future price.

In the case of futures trading, a trader has to keep a certain percentage of the future value with the broker as a margin to take the buy/ sell position. To buy an option contract, the buyer has to pay a premium.

Invest in equities, F&O, and upcoming IPOs effortlessly by opening a Demat account online. Enjoy a free subscription for the first year with Bajaj Broking.

Molecular Laser (ML) gratings are used primarily to tune the output wavelength of high powered lasers. High peak efficiencies, typically from 92 % - 96 %, are ...

The main difference between futures and options trading is that futures are a contract that obligates the buyer to purchase or sell an asset at a specified future date and price, while options give the buyer the right, but not the obligation, to purchase or sell an asset at a specified price and date.

Details of Compliance Officer: Ms. Kanti Pal (For Broking/DP/Research) | Email: compliance_sec@bajajfinserv.in/ Compliance_dp@bajajfinserv.in | Contact No.: 020-4857 4486 |

Infrared radiation has wavelengths from 780 nm to 1,000,000 nm (or 1 mm), longer than those of visible light. We sometimes think of infrared radiation from the ...

Risk: Options offer more flexibility and lower risk because the buyer can choose not to exercise the option if it's not profitable.

1. Bajaj Finance Limited (“BFL”) is a Non-Banking Finance Company (NBFC) and Prepaid Payment Instrument Issuer offering financial services viz., loans, deposits, Bajaj Pay Wallet, Bajaj Pay UPI, bill payments and third-party wealth management products. The details mentioned in the respective product/ service document shall prevail in case of any inconsistency with respect to the information referring to BFL products and services on this page.

However, there are many different fluorophores and some of them have overlapping bands. In samples with multiple fluorescence components it can be hard to differentiate between them with filters alone. Taking the full spectrum can reduce this confusion, and is also better optimized for complicated emission spectra.

Depending on whether the sensor is CCD or CMOS, it will transfer information to the next stage as either a voltage or a digital signal. CMOS sensors convert ...

You can trade in the future of indexes and stocks in the stock market. Each future contract has a different contract price. The margin requirement is specified by the exchange and depends on the volatility of the underlying asset.

F&O trading carries significant risks due to leverage and price volatility. Risks include market fluctuations, liquidity issues, and unexpected events affecting prices. Traders should have a thorough understanding of F&O products, employ risk management strategies, and only trade with funds they can afford to lose.

Microscopes are instruments used to see objects that are too small to be seen with the naked eye. There are many different types of microscopes that are optimized to “look” at small objects in different ways. Some microscopes use light, others use electrons, while a third type uses a probe to scan across the surface of the sample. These various techniques are optimized to give different information about the sample under study. Klar’s microscope are optical microscopes, since they use light to examine the sample. They use an LED to illuminate the sample and form an image on the camera, and they also use a laser and spectrometer for scanning the sample and capturing the spectrum at each point.

On the other hand, in options, the buyer of the contract selects the desired strike price and pays the respective premium to the seller of the contract. Whereas the seller of options deposits a margin to take the position.

The simplest optical microscope uses two lenses to magnify a sample, the objective and the eyepiece. The objective lens is what allows microscopes to provide a magnified real image, and produces the base magnification of the system. Early microscopes used a single lens for the objective, but multi-lens systems are generally used now due to their superior imaging performance which provides improved flat field correction and greatly reduced chromatic aberration.

Trusted by 50 million+ customers in India, Bajaj Finserv App is a one-stop solution for all your financial needs and goals.

Klar’s microscopes use a laser to ensure a narrow band monochromatic source and replace the camera with a spectrometer so all the emitted light is collected. Analyzing the full spectrum emitted by the sample at every point yields much more information. Klar’s analysis software, KlarFit, allows the user to fit the spectral data to various models. The researcher can deconvolve the spectra of overlapping fluorophores or even quantify small shifts in peak energy that would not be noticeable with a standard fluorescence setup.

Get FREE shipping when you buy Ray-Ban Optical frames. The Ray-Ban brand debuted in 1937 with the Aviator style created for U.S.A.F. pilots.

Infinity correctedtube lens

Infinity-correctedobjectivelens

Bajaj Auto Limited Complex Mumbai - Pune Road, Pune - 411035 MH (IN) Ph No.: 020 7157-6064 Email ID: investors@bajajfinserv.in

A fluorescence microscope uses the light-emitting properties of a material to study the substance. Typically, fluorophores (special dye molecules) are used to mark parts of the sample, such as proteins, tissues, or cells. Each fluorophore has specific absorption (excitation) wavelength and emission bands. Other materials, such as semiconductors or minerals, emit light intrinsically without the addition of dyes.

The tests were performed on the Panasonic Lumix LX100 camera: a high quality compact camera that has a relatively large sensor, excellent controls, and can ...

Infinity-corrected optical system

Futures and options are derivative contracts that can be bought and sold in the share market. Futures contract is where the buyer and seller of the contract agree to transact in the underlying asset on a future date at a price determined in advance. For example- Consider a futures contract of company ABC with an expiry date of August 25 is available at Rs. 100 (current price of ABC shares in live market is 105.) The buyer of this futures contract is making deal with the seller that on August 25, he will buy ABC shares at Rs. 100 per share irrespective of what the market price is on August 25.

Futures and options (F&O) are derivative products in the stock market. Since they derive their values from an underlying asset, like shares or commodities, they are called derivatives.

In a finite conjugate design, the objective focuses light from the object into the focal plane of the eyepiece so that the eyepiece produces parallel rays. An infinity corrected objective collects light from the object and forms a parallel beam that passes through a tube lens. The advantage of this design is that additional optical elements, such as polarizers, filters, and wave-plates, can be placed in between the tube lens and the objective without interfering with focusing of the beam. The infinite conjugate design is often used in fluorescence microscopes, which rely on filters.

Infinity objectivemarkers

Research Services are offered by Bajaj Financial Securities Limited as Research Analyst under SEBI Registration No.: INH000010043.

Both futures and options carry risk. Also, since these are leveraged instruments the extent of profit and loss, both are magnified.

Choice: Options provide the buyer with the choice (not obligation) to execute the contract. The seller, however, is obligated if the buyer chooses to execute.

Infinity corrected objectiveformula

The choice between futures and options depends on your financial goals, risk tolerance, and trading strategy. Both futures and options are derivatives contracts that can be used for speculation or risk management, but they have distinct characteristics:

Futures are contracts that must be settled (paid for) upon entering. If you enter a futures contract, you are obligated to buy or sell the underlying asset at a pre-specified price on or prior to a certain date.

Feb 23, 2017 — Low Dispersion, Low B-Integral CaF2 Vacuum Windows. Calcium fluoride features a very low spectral dispersion, a low non-linear refractive index.

Broking services offered by Bajaj Financial Securities Limited (Bajaj Broking) | REG OFFICE: Bajaj Auto Limited Complex, Mumbai –Pune Road Akurdi Pune 411035. Corp. Office: Bajaj Broking., 1st Floor, Mantri IT Park, Tower B, Unit No 9 &10, Viman Nagar, Pune, Maharashtra 411014. SEBI Registration No.: INZ000218931 | BSE Cash/F&O/CDS (Member ID:6706) | NSE Cash/F&O/CDS (Member ID: 90177) | DP registration No: IN-DP-418-2019 | CDSL DP No.: 12088600 | NSDL DP No. IN304300 | AMFI Registration No.: ARN –163403.

However, as previously stated, since precise price movement projections must be made, futures and options carry a significant level of risk. To make money from trading derivatives, it is important to have a solid understanding of stock markets, underlying assets, issuing companies, etc.

In a typical fluorescence setup, a broadband light source is used with a filter to select a specific spectral range. This filter light goes to a dichroic filter, which is used to reflect the excitation light to the sample and transmit the emitted light to the camera. Typical fluorescence microscopes use a set of filters to transmit only the emitted wavelength range to the camera or eyepiece. By blocking the other wavelengths of light, contrast is increased for that narrow spectral range only.

The primary purpose of derivatives is to hedge against the price movements of the underlying assets. Derivatives have an expiry date on which the contract expires. Derivatives don't offer actual ownership of the underlying assets at the expiration of the contract.

CCD sensors historically produced sharper images with less noise due to their analog charge transfer process. In comparison, the CMOS image sensor may have more ...

... Edmund and is part of The Head Bean Collection #9175-20. Edmund is the. ... 10cm Pocket Party Plushies: BG3 ...

It is possible to be profitable in F&O trading. One reason retail investors’ interest in Future and options trading is that it is a margin base trading, that is, a higher value position can be taken by just paying a portion of the full amount.

An options contract is the right, but not the obligation, for its buyer to buy or sell the underlying asset at a given price on or before a fixed date. Options are a good way to trade in stocks without owning them. If the option buyer does not want to buy or sell the underlying asset, they can decide not to do so.

The answer to whether future option trading is good or not depends on an individual's investment goals, risk tolerance, and their ability to make informed trading decisions. Futures and options are complex financial instruments that come with a significant level of risk, and it's essential to do thorough research and seek professional advice before trading in them.

To invest in futures and options, you would need an F&O Demat and trading account. To invest in futures, the investor pays a margin which is a portion of the total stake to take a position. Once the margin is paid the exchange matches your order with available buyers or sellers in the market.

Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment.

Ms.Cici

Ms.Cici

8618319014500

8618319014500